The AI-Native Pricing Revolution: Moving Beyond Rule-Based Retail in 2026

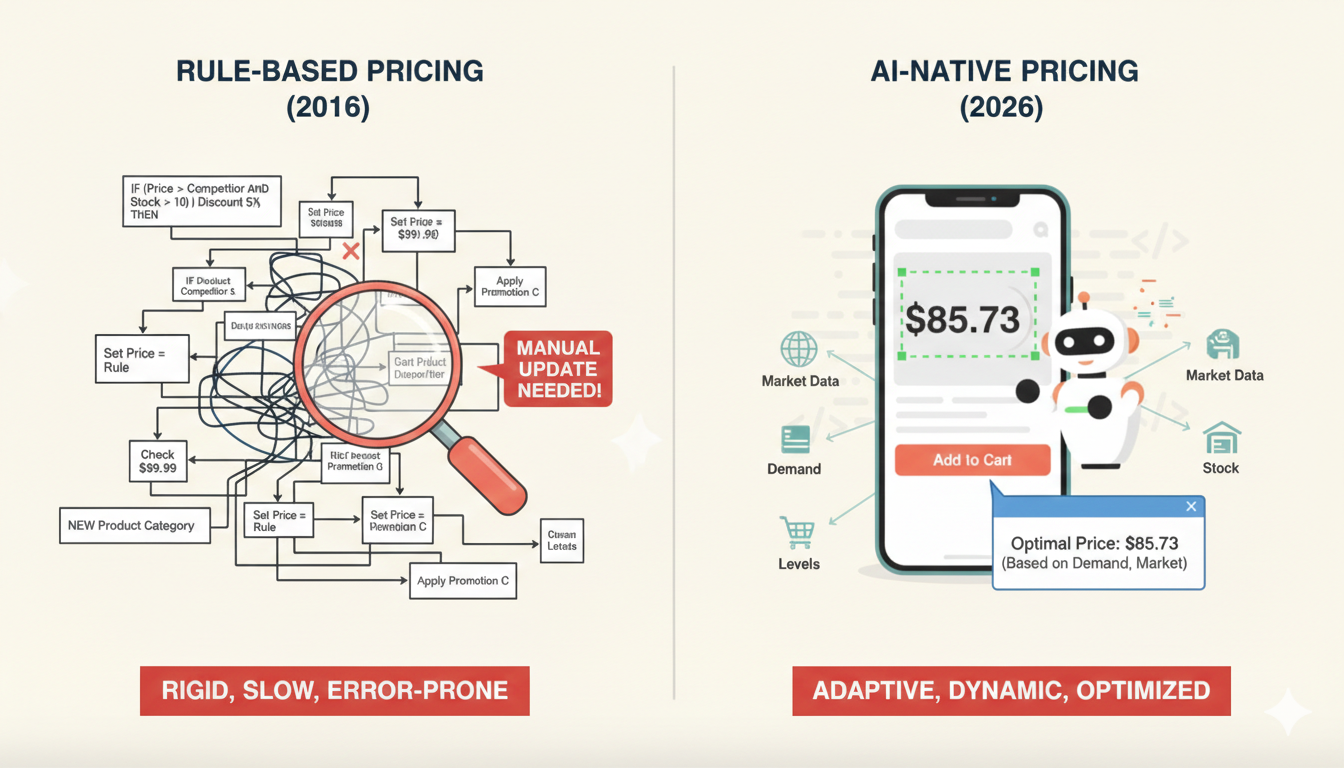

The End of the "Set and Forget" Era

In the early 2020s, retail pricing was a game of simple arithmetic: Cost + Margin = Price.

Even the first wave of "dynamic pricing" was fundamentally reactive, relying on rigid "if-then" rules like:

"If Competitor A drops their price by 5%, drop mine by 6%."

In 2026, those rules have become a competitive liability. The modern market moves at the speed of algorithms, not manual updates.

Today, AI-native enterprises are utilizing Agentic Pricing Models that don't just react to the market—they predict it.

This report explores how high-fidelity web intelligence is fueling the shift from reactive discounting to proactive, real-time value optimization.

Why Rule-Based Pricing Fails in the 2026 Market

Traditional rule-based systems were designed for a static world.

In 2026, the retail environment is defined by "The Butterfly Effect." A viral social media trend in Seoul can deplete inventory in London within minutes.

A rule-based system, blinded by rigid parameters, misses the "Sentiment Signal" that would justify a 20% price premium due to sudden scarcity.

Furthermore, rules are predictable. Sophisticated competitors now use "Price Trap" Scrapers specifically designed to trigger your automated rules.

By briefly dropping a price they don't actually intend to sell at, they force your system into a "race to the bottom," bleeding your margins while maintaining theirs.

Key Takeaway: If your pricing logic is a public secret (based on visible competitors), you are vulnerable to manipulation.

The Data Foundation – Real-Time Market Elasticity

To win in 2026, you need to understand Price Elasticity at the SKU level, updated hourly.

This requires a "Feedback Loop" between external web data and internal inventory metrics.

2.1 The Scarcity Signal

One of the most powerful predictors of price elasticity is Competitor Inventory Health.

Using ScrapeWise, retailers monitor not just the price, but the "Add to Cart" availability across 50+ competitor sites.

If a primary competitor goes "Out of Stock," your AI-native engine recognizes a localized monopoly and instantly adjusts your price upward to maximize margin without losing a single sale.

2.2 Cross-Channel Price Gaps

Consumers in 2026 are "platform agnostic." They check Amazon, TikTok Shop, and Direct-to-Consumer (DTC) sites simultaneously.

An AI-native engine monitors these gaps. If your DTC price is significantly higher than your Amazon listing, the engine flags a "Channel Conflict" and aligns them to prevent brand erosion.

The Architecture of an Agentic Pricing Engine

How does this look under the hood?

An AI-native engine moves away from simple database queries and toward Neural Elasticity Modeling.

3.1 The Input Layer: Multi-Source Intelligence

The engine ingests thousands of data points every second via ScrapeWise, including:

- Visual Data: Banners, "limited time" badges, and countdown timers on competitor sites.

- Macro Data: Local weather (demand for umbrellas vs. sunblock), traffic patterns, and regional economic indices.

- Semantic Data: Sentiment scores from the latest product reviews and Reddit discussions.

3.2 The Prediction Layer: Bayesian Inference

Instead of a "Yes/No" rule, the engine uses Bayesian Statistics to calculate the probability of a sale at various price points:

$$P(Sale | Price, CompetitorStock, Sentiment)$$

This formula allows the AI to determine the "Sweet Spot"—the exact price that balances the highest possible margin with the highest probability of conversion.

Beating the "Shadow Discount" Crisis

A major challenge in 2026 is the Shadow Discount.

Retailers have become experts at hiding their true prices from basic scrapers. They might show a lower price only to users who:

- Are browsing from a specific high-competition zip code.

- Are arriving from a "referral" link.

- Are logged into a loyalty app.

Legacy scrapers see the "MSRP" and think the market is stable.

ScrapeWise uses Browser Realism to mimic these specific user personas, uncovering the "True Market Price" that your competitors are actually charging.

Operational Roadmap – Implementing AI Pricing

Transitioning to an AI-native model isn't a "flip of a switch." It requires a structured migration.

| Phase | Action | Goal |

|---|---|---|

| Phase 1: Shadowing | Run AI pricing in the background without pushing to live. | Compare AI suggestions vs. human rules. |

| Phase 2: Pilot | Roll out AI pricing for a single high-volume category. | Measure "Margin Lift" over a 30-day period. |

| Phase 3: Guardrail Scaling | Implement "Semantic Guardrails" and scale to all SKUs. | Ensure brand consistency at scale. |

The "Semantic Guardrail" – Balancing Profit and Brand

The biggest fear for CEOs is an AI "going rogue"—raising a price to $10,000 during a crisis or dropping it to $0.01 due to a data error.

In 2026, we use Semantic Guardrails. These are natural language rules that the AI must follow, such as:

- "Never exceed the MSRP by more than 15%."

- "Never price below the landed cost of goods."

- "If a competitor is out of stock, increase price by a maximum of 5% to maintain 'Fair Play' brand status."

ROI and the Economic Impact of Intelligence

The shift to AI-native pricing isn't just a tech upgrade; it's an economic imperative. Organizations using high-fidelity web intelligence report:

- 12–18% Increase in Gross Margin: By capturing "Lost Profit" during competitor stockouts.

- 22% Reduction in Inventory Carrying Costs: By liquidating slow-moving stock via localized, micro-discounts rather than store-wide sales.

- 90% Less Manual Labor: Shifting the pricing team from "Data Entry" to "Strategic Oversight."

Data is the Only Edge

In a world of razor-thin margins and instant price-matching, your only sustainable advantage is Information Velocity.

If you see the market shift 10 minutes before your competitor, you win. If you see it 10 minutes after, you've already lost the sale.

AI-native pricing is the ultimate expression of retail intelligence.

Is your strategy built on the filtered data of the past, or the visual truth of the present?