The AI-Native Pricing Revolution: Moving Beyond Rule-Based Retail in 2026

The era of "Cost + Margin = Price" is over.

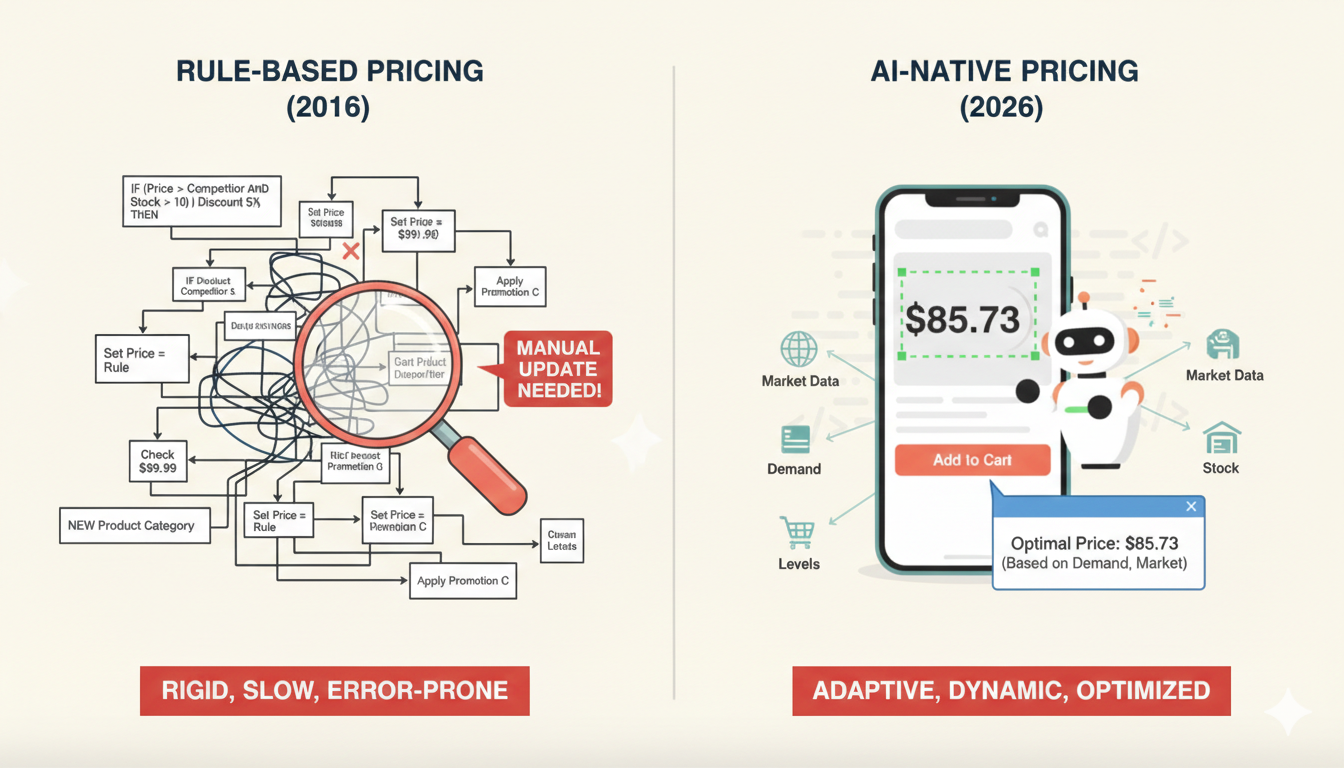

Even the first wave of "dynamic pricing" was fundamentally reactive, relying on rigid "if-then" rules like: "If Competitor A drops their price by 5%, drop mine by 6%."

In 2026, those rules have become a competitive liability. The modern market moves at the speed of algorithms, not manual updates.

Today, AI-native enterprises are deploying Agentic Pricing Models that don't just react to the market—they predict it. According to Gartner research, 90% of e-commerce businesses will implement some form of AI-driven dynamic pricing by 2026, while 55% of European retailers are actively piloting dynamic pricing with Generative AI this year.

This guide explores how high-fidelity web intelligence is fueling the shift from reactive discounting to proactive, real-time value optimization—and why agentic AI workflows are now autonomously managing pricing, inventory, and promotions as truly real-time, adaptive systems.

Why Rule-Based Pricing Fails in the 2026 Market

Traditional rule-based systems were designed for a static world.

In 2026, the retail environment is defined by "The Butterfly Effect." A viral TikTok trend in Seoul can deplete inventory in London within minutes. A rule-based system, blinded by rigid parameters, misses the "Sentiment Signal" that would justify a 20% price premium due to sudden scarcity.

Furthermore, rules are predictable. Sophisticated competitors now use "Price Trap" Scrapers specifically designed to trigger your automated rules. By briefly dropping a price they don't actually intend to sell at, they force your system into a "race to the bottom," bleeding your margins while maintaining theirs.

The data confirms this shift is imperative: companies using AI and generative AI have seen 23% higher profitability, while those stuck on legacy systems continue losing margin to more agile competitors.

Key Takeaway: If your pricing logic is a public secret based on visible competitors, you are vulnerable to manipulation.

The Data Foundation: Real-Time Market Elasticity

To win in 2026, you need to understand Price Elasticity at the SKU level, updated hourly.

This requires a "Feedback Loop" between external web data and internal inventory metrics. Modern AI techniques enable price elasticities to be calculated for individual SKUs for point-of-sale segments—a granularity impossible with legacy monthly category-level models.

The Scarcity Signal

One of the most powerful predictors of price elasticity is Competitor Inventory Health.

Using ScrapeWise, retailers monitor not just the price, but the "Add to Cart" availability across 50+ competitor sites. If a primary competitor goes "Out of Stock," your AI-native engine recognizes a localized monopoly and instantly adjusts your price upward to maximize margin without losing a single sale.

AI analyzes transactional data to identify elasticity at the SKU, region, and segment level—allowing decision-makers to confidently adjust prices without undercutting perceived value or over-discounting.

Cross-Channel Price Gaps

Consumers in 2026 are "platform agnostic." They check Amazon, TikTok Shop, and Direct-to-Consumer (DTC) sites simultaneously.

An AI-native engine monitors these gaps. If your DTC price is significantly higher than your Amazon listing, the engine flags a "Channel Conflict" and aligns them to prevent brand erosion. This cross-channel intelligence has become critical as AI-driven e-commerce traffic surged 693% during the 2025 holiday season compared to 2024.

The Architecture of an Agentic Pricing Engine

How does this look under the hood?

An AI-native engine moves away from simple database queries and toward Neural Elasticity Modeling. Unlike rule-based systems, AI adapts as new variables enter the equation, accounting for nuanced patterns in customer behavior and market movement.

The Input Layer: Multi-Source Intelligence

The engine ingests thousands of data points every second via ScrapeWise, including:

Visual Data: Banners, "limited time" badges, and countdown timers on competitor sites.

Macro Data: Local weather (demand for umbrellas vs. sunblock), traffic patterns, and regional economic indices.

Semantic Data: Sentiment scores from the latest product reviews and social media discussions.

This multi-source approach mirrors what leading retailers are already implementing. McKinsey research shows that agentic AI can cleanse and reconcile information autonomously, getting better with every cycle—unlike legacy systems that require constant manual intervention.

The Prediction Layer: Bayesian Inference

Instead of a "Yes/No" rule, the engine uses Bayesian Statistics to calculate the probability of a sale at various price points:

P(Sale | Price, CompetitorStock, Sentiment)

This formula allows the AI to determine the "Sweet Spot"—the exact price that balances the highest possible margin with the highest probability of conversion. Reinforcement learning algorithms adjust in real time, incorporating external factors like regional inflation and social media trends, cutting elasticity calculation errors by up to 38%.

Beating the "Shadow Discount" Crisis

A major challenge in 2026 is the Shadow Discount.

Retailers have become experts at hiding their true prices from basic scrapers. They might show a lower price only to users who are browsing from a specific high-competition zip code, arriving from a "referral" link, or logged into a loyalty app.

Legacy scrapers see the "MSRP" and think the market is stable.

ScrapeWise uses Browser Realism to mimic these specific user personas, uncovering the "True Market Price" that your competitors are actually charging. This capability has become essential as 68% of retailers plan to deploy agentic AI in the next 12–24 months, making accurate competitive intelligence the foundation of survival.

Operational Roadmap: Implementing AI-Native Pricing

Transitioning to an AI-native model isn't a "flip of a switch." It requires a structured migration.

Phase 1 — Shadowing: Run AI pricing in the background without pushing to live. Compare AI suggestions vs. human rules to build confidence and identify gaps.

Phase 2 — Pilot: Roll out AI pricing for a single high-volume category. Measure "Margin Lift" over a 30-day period. Companies have reported 10-25% revenue lifts within six months of implementing dynamic pricing.

Phase 3 — Guardrail Scaling: Implement "Semantic Guardrails" and scale to all SKUs, ensuring brand consistency at scale.

Accenture's recent investment in Profitmind underscores this phased approach—their agentic AI platform helps retailers automate decisions across pricing, inventory, and planning while maintaining human oversight during the transition.

The "Semantic Guardrail": Balancing Profit and Brand

The biggest fear for CEOs is an AI "going rogue"—raising a price to $10,000 during a crisis or dropping it to $0.01 due to a data error.

In 2026, we use Semantic Guardrails. These are natural language rules that the AI must follow, such as:

"Never exceed the MSRP by more than 15%."

"Never price below the landed cost of goods."

"If a competitor is out of stock, increase price by a maximum of 5% to maintain 'Fair Play' brand status."

This approach aligns with what MIT Sloan Management Review describes as the emerging best practice: using natural language prompts to guide AI pricing decisions while maintaining explainability and brand alignment.

ROI and the Economic Impact of Intelligence

The shift to AI-native pricing isn't just a tech upgrade—it's an economic imperative.

Organizations using high-fidelity web intelligence report:

12–18% Increase in Gross Margin: By capturing "Lost Profit" during competitor stockouts. McKinsey confirms that effectively linking pricing and promotions using machine learning can increase revenue and profits by three to five percentage points overall.

22% Reduction in Inventory Carrying Costs: By liquidating slow-moving stock via localized, micro-discounts rather than store-wide sales.

90% Less Manual Labor: Shifting the pricing team from "Data Entry" to "Strategic Oversight."

The market momentum is undeniable. The global AI in retail industry is projected to reach $15.3 billion by 2026, with a CAGR of 36.6%. Meanwhile, the dynamic pricing software market is expected to grow from $6.16 billion in 2025 to $41.43 billion by 2033—a 31.29% CAGR that reflects the strategic importance of real-time pricing data.

The Rise of Agentic Commerce

As we look toward the rest of 2026 and beyond, the most transformative trend is the shift from AI as a tool to AI as an agent.

McKinsey's analysis of agentic commerce describes a future where AI agents operate against standing goals rather than one-off transactions—goals like "Keep household essentials under $300 per month" or "Maintain my airline loyalty status at the lowest total cost."

For retailers, this means competition shifts from winning a single purchase to earning a place in the agent's ongoing plan. Merchants need deeper integration—especially around loyalty, eligibility, substitutions, and service guarantees—so agents can reason about trade-offs and execute reliably.

Traffic from AI sources has already surged 1,200% for retailers, while traditional search traffic declined 10% year-over-year. If your pricing data isn't accurate and machine-readable, you risk being invisible to the AI shoppers of tomorrow.

Key Takeaways for 2026 Pricing Leaders

Predictive Beats Reactive: Rule-based pricing is a competitive liability. AI-native engines predict market shifts before they happen.

Granularity is Everything: SKU-level, location-specific, persona-aware pricing is now table stakes—not a differentiator.

Shadow Discounts Require Browser Realism: APIs and basic scrapers miss the true competitive landscape. Only frontend intelligence extraction reveals what customers actually see.

Guardrails Enable Trust: Semantic constraints keep AI aligned with brand values while enabling autonomous execution.

The Hybrid Future is Now: Agentic AI workflows are already managing pricing, inventory, and promotions as unified, adaptive systems.

Data is the Only Edge

In a world of razor-thin margins and instant price-matching, your only sustainable advantage is Information Velocity.

If you see the market shift 10 minutes before your competitor, you win. If you see it 10 minutes after, you've already lost the sale.

AI-native pricing is the ultimate expression of retail intelligence.

Is your strategy built on the filtered data of the past—or the visual truth of the present?

Frequently Asked Questions

How does Agentic Pricing differ from the dynamic pricing we used in 2022?

Traditional dynamic pricing was reactive and linear (e.g., "If X happens, do Y"). Agentic pricing is proactive and multimodal. It doesn't just follow a script—it uses Bayesian inference to weigh thousands of variables like social media sentiment, local weather, and competitor inventory to predict the optimal price before the market even shifts.

What is a "Price Trap" scraper and how do I avoid it?

A Price Trap occurs when a competitor temporarily lowers a price (often on an item they have no stock of) just to trick your automated rules into a race to the bottom. AI-native engines avoid this by cross-referencing price drops with inventory health. If the competitor has no "Add to Cart" availability, the AI ignores the price drop, protecting your margins.

What are Semantic Guardrails and why are they necessary?

Semantic Guardrails are natural language constraints that keep the AI aligned with your brand values. They prevent algorithmic errors or PR disasters—such as price gouging during a crisis—by setting hard boundaries like "Never price below landed cost" or "Maintain a maximum 15% variance from MSRP."

How does the engine find True Market Prices if competitors hide them?

In 2026, many retailers use Shadow Discounts based on a user's zip code or referral source. We use Browser Realism to mimic diverse user personas. This allows the engine to see the "visual truth"—the actual price a real customer sees—rather than the generic MSRP shown to basic bots.

What kind of ROI can a retail enterprise realistically expect?

By transitioning to high-fidelity web intelligence, organizations typically achieve a 12–18% lift in gross margins, a 22% reduction in inventory carrying costs, and a 90% decrease in manual pricing labor. Research shows eCommerce companies using dynamic pricing see 5–15% higher conversion rates and up to 25% improvement in profit margins.

How long does it take to implement AI-native pricing?

Most organizations follow a three-phase approach: Shadowing (4–6 weeks of parallel running), Pilot (30-day category test), and Guardrail Scaling (phased rollout). Total implementation typically takes 3–6 months, with measurable ROI visible within the first 60 days of the pilot phase.

What data infrastructure is required for AI-native pricing?

You need historical sales data, competitor pricing feeds, inventory levels, and ideally external signals like weather and social sentiment. The key is ensuring data is clean, consistent, and machine-readable. Modern platforms can work with existing ERP, POS, and e-commerce systems through API integrations.

How does AI-native pricing handle Key Value Items (KVIs)?

AI-native systems include KVI modules that statistically score each item's importance to consumer price perception. The system recognizes that some items drive store traffic and brand perception—and automatically protects competitive positioning on these items while optimizing margin on less price-sensitive products.

What happens when AI pricing conflicts with promotional calendars?

Advanced systems integrate with promotional planning, recognizing that a pre-planned promotion should override dynamic adjustments. Semantic Guardrails can include rules like "Honor all committed promotional prices" while still optimizing non-promotional SKUs in real-time.

Is AI-native pricing only for large retailers?

No. Generative AI has democratized access to sophisticated pricing capabilities. MIT research shows that LLM-based pricing provides an accessible, low-cost alternative to traditional algorithms—empowering even small businesses to benefit from AI-driven pricing decisions without custom code or massive data science teams.